:quality(80)/business-review.eu/wp-content/uploads/2015/09/SMEs.jpg)

With more than three times fewer SMEs per 1,000 inhabitants than the European Union, Romania is making efforts to encourage the so-called “engine of the economy”.

Anda Sebesi

The 2015 Romanian Entrepreneurship Barometer – Entrepreneurs Talk, conducted by EY Romania, found that small and medium enterprises (SMEs) represent 99.6 percent of the total number of companies active in Romania, compared with 99.8 percent in the European Union (EU). Meanwhile, local SMEs are responsible for 44 percent of the total gross added value registered in the local economy, versus 59 percent in the EU. The same research found that 66.2 percent of Romanian employees work for an SME (against 66.9 percent in the EU). In addition, five sectors generate about 70 percent of the total gross added value (production, commerce, construction, professional activities and transportation) while three sectors account for over 60 percent of the employees of SMEs namely commerce, production and construction.

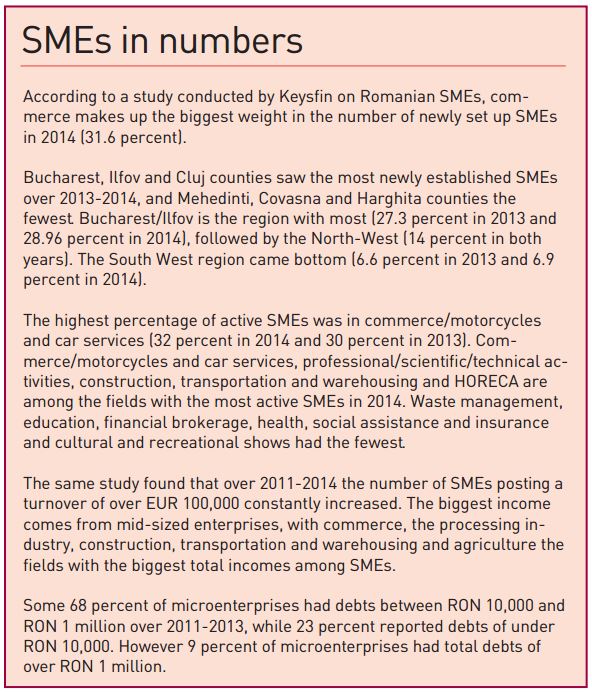

The EY barometer also found that 2.6 million companies have been founded in the past 25 years, and a limited liability company lasts for 9 years, 9 months and 22 days on average. According to a study conducted by Keysfin, 30 percent of the total Romanian SMEs were established between 2005 and 2009. Since 2009 an average of 45,000 SMEs have been established each year.

The latest data available on the market show that there are just 24-25 SMEs per 1,000 inhabitants compared with an average of 64-65 in the EU. In addition, their capitalization is six times lower than the European level, even though both in Romania and the EU they have been the sole sector to have created new jobs in the past two decades.

To give impetus to local SMEs, last year the Romanian authorities adopted Law no. 62 allocating more money through EU funds such as seed capital, micro-grants, microcredits and venture capital. According to National Council of Romanian Private Small and Medium Enterprises (CNIPMMR) estimations, these financial resources could allow the establishment of at least 50,000 companies, the development of a minimum of 60,000 SMEs and the creation of at least 400,000 new jobs.

“Entrepreneurship is more dynamic than ever in Romania now. Meanwhile, discussions about failure in business have become more relaxed. This is a normal trend for the communication around entrepreneurship that indicates that entrepreneurs feel more comfortable to talk about the obstacles they have faced,” said Mihaela Matei, coordinator of the EY study, quoted by the barometer. She adds that if this continues, the Romanian entrepreneurial environment will develop very rapidly in response to the lack of attractive career options for youngsters.

What do entrepreneurs think?

According to the Business Arena Barometer conducted by Raiffeisen Bank this summer on over 245 entrepreneurs from Timisoara, Cluj, Brasov, Iasi and Constanta, the three biggest obstacles to the development of entrepreneurial businesses are the level of taxation, the general situation of the local economy and a lack of political stability and vision in politics. In addition, the research cites uncertainty, bureaucracy, lack of entrepreneurial education and the difficult access to financing. According to the Raiffeisen Barometer, a stable taxation and regulation environment, simplification of taxation and regulations and a decrease of indirect tax (like that on salaries and properties) are the top three measures required to develop entrepreneurship in Romania on the long term.

In the same barometer, 95 percent of entrepreneurs said they were optimistic about the direction the Romanian economy is going in (52 percent are optimistic, 40 percent are partly optimistic and 3 percent are very optimistic). In addition, 88 percent of entrepreneurs say that their turnover will increase in 2015. Of these, 12 percent envision an increase of over 30 percent, 13 percent expect an increase of between 20 and 30 percent, 29 percent think that their turnover will rise between 10 and 20 percent, and 20 percent between 5 and 10 percent.

Families see their firms grow

Almost three quarters (74 percent) of family businesses in Romania registered an increase in turnover over the last financial year, while at global level, 65 percent of family firms had similar turnover increases, according to this year’s PwC Family Business Survey.

Regarding growth perspectives for the next five years, Romanian entrepreneurs are more cautious than their global counterparts: 75 percent aim to develop their business over the next five years, compared to 85 percent at global level. Some 62 percent of the Romanian respondents expect constant growth for the business over the next five years, while 13 percent are betting on an accelerated and fast development.

When asked to name the biggest three challenges in the next twelve months, Romanian respondents said that they are first of all concerned about attracting key talent. They are also more concerned about the reorganization of their company than entrepreneurs at global level (39 percent versus 28 percent).

Both in Romania and at global level, about a quarter mentioned business and product portfolio development as major challenges. When asked the main three external challenges over the next year, entrepreneurs mentioned market conditions and Eurozone uncertainty (56 percent), government policies and regulations (38 percent) and fierce competition (28 percent).

Romanian family businesses owners also cited the need for constant innovation, the general economic context, market instability, attracting key talent, fierce competition and accelerated globalization as the key challenges for their companies over the next five years.

“Family businesses have learned to navigate through murky waters and are beginning to think long term, since the need for innovation has become their top concern, while in the previous edition of the survey the general economic situation was considered the main threat,” commented Ionut Simion, partner, leader of the tax services for family businesses team at PwC Romania.

The survey reveals three major concerns facing the local family firm, starting with the need for professionalization. The importance of becoming professional on all grounds – from systems and procedures, to company management – has increased since the previous edition of the survey, given the price pressures, cost increases and megatrends impacting the global economy. Business professionalization must be accompanied by the professionalization of the family and its relationship with the company. Second is succession planning. A “family factor” dynamic can have a major effect on the company, which seems to be ignored by family businesses at the moment. Last but not least is the importance of innovation. Family firms in Romania are finding it harder to be competitive in the current economic climate and are aware of the need to keep up with changes in a more fluid and disruptive environment where innovation is key, but skills availability is limited and competition is becoming ever more aggressive.

“Romanian family businesses are going through one of the most important stages of their evolution from 1989 to the present day – the transfer to the second generation. This stage will either end in keeping the business in the family (transfer to the second generation), or the family will lose control of the business through an exit; unfortunately, some companies will also disappear,” says Alexandru Medelean, director, leader of the private company services team at PwC Romania. He adds that the proportions of these transformations are almost impossible to anticipate.

“Following the crisis, most Romanian family businesses are at a crossroads. How they will manage to harness the advantages and address the challenges, both internal and at global level, where the speed of change is beyond any projected forecasts, will be decisive for the future of Romanian capital,” concluded Mihai Anita, partner leader of the assurance services team for family businesses. In Romania, 61 interviews were conducted for the study.

European Commission boosts SMEs

At present there are over 20 million SMEs and about 50,000 large companies in the EU. In mid June the European Commission presented an action plan to reform extensively the taxation system of EU companies. It sets out a series of initiatives to fight tax evasion, ensure sustainable inputs and consolidate the united market for companies. These measures should significantly improve the taxation system for EU companies, making it more reasonable, effective and favorable to future growth. The key actions also include a strategy for re-launching companies’ common consolidated fiscal base and a framework to guarantee effective taxation where companies generate profits, creating a better fiscal environment for firms, increasing transparency and improving the coordination of fiscal procedures within the EU. The public commission also launched a conference to evaluate whether companies should make public some of their fiscal information.

Measures to fuel SMEs

Recently, the National Fund for the Guarantee of Credits for SMEs (FNGCIMM) proposed to the minister of public finance two state guarantee schemes dedicated to both start-ups and SMEs in difficulties. “We cannot talk about the real encouragement of entrepreneurs without improving their access to financing. The guarantee scheme for start-ups ensures them some of the guarantees needed to get credit for the initial investment and develop their business,” Silvia Ciornei, president and general manager at the FNGCIMM, told Mediafax. For investment loans the guarantee will be up to RON 300,000 with a maximum reimbursement period of five years.

Elsewhere, SMEs will be able to access EUR 100 million of funds for their investments and working capital with grant-aided interest and reduced guarantees from Banca Transilvania, BRD Groupe Societe Generale, CEC Bank, ProCredit Bank and Raiffeisen Bank. This came after Romania boosted the resources for the JEREMIE program, allotted from the 2007-2013 structural funds, by EUR 50 million. “We are glad that the financial instruments financed from structural funds meet the needs of Romanian SMEs during this difficult period. Now that we have proved that structural funds can be used effectively to support SMEs’ access to financing, member states can start from a solid base to continue to implement this type of instrument in a new period of programs,” said Hubert Cottogni, deputy general manager at the European Investment Fund (EIF), quoted by Mediafax.

Romania still attractive to investors

Romania remains one of the most attractive investment spots in the region, judging by the surge in yearly revenue growth of the Romanian companies present in the Deloitte Central Europe Top 500. The largest local firms in the ranking saw median annual revenue growth of 5.3 percent compared to the regional rate of just 0.3 percent.

The number of companies from Romania present in the ranking increased to 46 as compared to 42 in 2014, placing the country fourth, one position higher than the year before. The combined revenues of the firms from Romania rose by almost 7 percent to EUR 46 billion. By way of contrast, the combined revenues of all companies in the Top 500 dropped by 1.8 percent to EUR 682 billion from last year. Also, 30 companies from Romania improved their ranking and eight new entries made it into the ranking.

“Romania’s place in the ranking clearly reflects the country’s good positioning and attractiveness for investment. With steady microeconomic growth, Romania ranks among the regional champions in terms of economic growth. The momentum is expected to continue but that depends very much on the country’s political, legal and fiscal stability, which are key elements for a more significant economic and business environment boost,” said Ahmed Hassan, country managing partner at Deloitte Romania.

The ninth Deloitte Central Europe Top 500 was conducted among 18 countries across Central Europe and Ukraine (500 companies, 50 banks and 50 insurance companies).

Energy and resources remained the industry which contributed most to the country’s ranking with total revenues of EUR 18.943 billion followed by consumer business and transportation with EUR 13.378 billion, manufacturing with EUR 9.526 billion, technology, media and telecommunication with EUR 2.849 billion and life sciences with EUR 1.311 billion.

“Statistics show that the entrepreneurial activity in Romania has reached its peak and the rate of those intending to start a new business within three years is the highest in the region. However, the fact that we have only three Romanian entities owned by local entrepreneurs in the ranking is a sign that the availability of resources is still low and public policies are not encouraging enough to put money at risk,” said George Mucibabici, chairman of Deloitte Romania.

According to Hein van Dam, partner-in-charge, financial advisory practice, Deloitte Romania, in the next couple of years there will be more companies owned by local entrepreneurs represented in the ranking. “Romania may become a much more interesting player on the market. If it focuses on the fundamentals in attracting investment, there is no reason why Romania should not become the second largest Central European economy after Poland,” he said.

:quality(80)/business-review.eu/wp-content/uploads/2024/04/coffeeast-3.jpeg)

:quality(80)/business-review.eu/wp-content/uploads/2024/02/IMG_6951.jpg)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/COVER-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/10/Ruxandra-Cord-fondatoare-theCoRD.ai-1.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2023/06/Screenshot-2023-06-13-at-2.18.04-PM.png)

:quality(50)/business-review.eu/wp-content/uploads/2023/06/Screenshot-2023-06-07-at-12.18.12-PM.png)

:quality(80)/business-review.eu/wp-content/uploads/2024/04/cover-april.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/Slide1.png)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/1_Transport.jpg)

:quality(50)/business-review.eu/wp-content/uploads/2024/04/0x0-Supercharger_18-scaled.jpg)